Steps to Buy a Used Car with Auto Network Cars and Financing Options

Buying a car can seem hard, but following certain steps can help a lot. When purchasing a used car, financing is very important. Over 80% of new cars in the U.S. are financed, highlighting how common and accessible financing can be. Auto network cars platforms simplify the buying process by providing various financing options. They offer competitive rates and flexible plans to fit your needs. With the right tools and tips, buying a car feels easier and more enjoyable.

Key Takeaways

Set a clear budget before starting your car search to avoid overspending and ensure financial stability.

Understand your credit score and seek pre-approval for a loan to strengthen your buying position and secure better rates.

Aim for a down payment of at least 20% to reduce your loan amount and monthly payments, making your purchase more manageable.

Research and compare different financing options, including banks, credit unions, and online lenders, to find the best rates and terms.

Thoroughly inspect and test drive any used car to uncover potential issues and ensure it meets your expectations.

Use tools like Kelley Blue Book to determine fair car prices, empowering you to negotiate effectively and get the best deal.

Complete all necessary paperwork carefully and ensure you have insurance and registration in place before driving your new car home.

Setting a Budget and Exploring Used Car Financing

When buying a used car, setting a budget is the first step to ensure you make a smart financial decision. Understanding how much you can afford helps you stay on track and avoid overspending. Let’s break this process into manageable steps.

Assessing Your Financial Situation

Start by taking a close look at your finances. Review your income, monthly expenses, and savings. This will help you determine your budget for the car purchase. Remember, the cost of owning a car doesn’t stop at the sticker price. You’ll also need to account for insurance, maintenance, and fuel costs.

A good rule of thumb is to keep your car-related expenses, including the monthly payment, below 15% of your monthly income. This ensures you don’t stretch your finances too thin. If you’re unsure where to begin, consider using online budgeting tools or calculators to get a clearer picture of what you can afford.

Understanding Credit Scores and Loan Pre-Approval

Your credit score plays a big role in the auto loan process. Lenders use it to decide the interest rate and terms of your loan. A higher credit score often means better rates, which can save you money over time. If you don’t know your score, check it before applying for financing. Many banks and credit card companies offer free credit score checks.

Once you know your score, the next step is to get pre-approval for a loan. This is one of the best ways to buy a used car because it gives you a clear idea of how much you can borrow and what your interest rate will be. Pre-approval also shows sellers that you’re a serious buyer, which can give you an edge during negotiations.

Planning for Down Payments and Monthly Payments

A down payment is the amount you pay upfront when buying a car. The more you can put down, the less you’ll need to borrow. This reduces your monthly payment and can even lower your interest rate. Experts recommend aiming for a down payment of at least 20% of the car’s price, but any amount helps.

When planning your monthly payment, think about what fits comfortably within your budget. Avoid focusing only on the lowest payment possible, as this could mean a longer loan term and higher overall costs. Instead, balance affordability with a reasonable loan term, typically between 36 and 60 months.

If you’re exploring used car financing, compare options from banks, credit unions, and online lenders. Each may offer different rates and terms, so take the time to find the best fit for your needs. This step is crucial in the auto loan process and ensures you’re making a financially sound decision.

By assessing your finances, understanding your credit score, and planning for both a down payment and monthly payment, you’ll be well-prepared to navigate the world of used car financing. These steps set the foundation for a smooth and stress-free car-buying experience.

Researching and Picking the Best Car

Choosing the right car starts with knowing what you need. This step helps you focus and make smart choices. Here’s how to research and pick the best car.

Knowing What You Need and Want

Think about how you’ll use the car every day. Do you need a small car for city driving? Or do you want a big SUV for family trips? Look at things like gas mileage, seats, and storage. If you drive far, a fuel-efficient car is important. For road trips, comfort and features like GPS might matter.

Make a list of must-haves and nice-to-haves. This keeps you focused while shopping. Think about your lifestyle too. If winters are snowy where you live, an all-wheel-drive car is smart. By knowing your needs, you’ll save time and avoid confusion.

Looking at Certified Pre-Owned Cars

Certified Pre-Owned (CPO) cars are great if you want a reliable car without paying for a new one. These cars are cheaper than new ones but come with warranties from the maker. CPO cars are usually newer and have fewer miles. They pass strict checks for safety and quality.

CPO cars often include extras like longer warranties and better loan rates. These perks make them a good choice for peace of mind. For example, CPO cars usually have service records and no accident history. This makes you feel sure about your buy. They cost more than regular used cars, but the benefits can be worth it.

Checking the Car’s History and Reviews

Always check a car’s history before buying it. A history report shows past accidents, owners, and repairs. Websites like Carfax or AutoCheck can help you find this. A clean report means no hidden problems.

Also, check how reliable the car is. Research the model to see how it holds up over time. Read reviews from owners and experts. Some cars last long, while others have common issues. Knowing this helps you avoid costly repairs later.

By researching and picking carefully, you’ll feel good about your choice. Whether you care about features, reliability, or price, these steps will help you find the perfect car.

Inspecting and Test Driving the Car

When buying a used car, taking the time to inspect and test drive the car is essential. This step helps you uncover potential issues and ensures the vehicle meets your expectations. Let’s break it down into two key parts.

Conducting a Comprehensive Inspection

Before you even start the engine, give the car a thorough inspection. Walk around the vehicle and look for visible signs of damage, such as dents, scratches, or rust. Check the tires for wear and tear. Uneven tread could indicate alignment issues. Open and close all doors, windows, and the trunk to ensure they function properly.

Pop the hood and examine the engine. Look for leaks, corrosion, or worn belts. Don’t forget to check the oil and other fluid levels. A clean engine bay doesn’t always mean the car is in perfect condition, but it’s a good sign that the previous owner took care of it.

Inside the car, inspect the seats, dashboard, and controls. Test the air conditioning and heating systems. Even if the A/C seems fine, it might hide problems that could cost you later. Turn it on full blast and listen for unusual noises or weak airflow. Small details like these can save you from unexpected repairs.

Evaluating the Car’s Performance During a Test Drive

The test drive is your chance to see how the car performs on the road. Start by driving in a quiet area to focus on how the car feels. Pay attention to the steering, brakes, and acceleration. Does the car respond smoothly? Are there any strange noises or vibrations?

Take the car on different types of roads if possible. Drive on highways to test higher speeds and city streets to check stop-and-go traffic performance. Try parking the car to see how easy it is to maneuver. If the seller allows, test it on hills to evaluate the transmission and braking system.

While driving, trust your instincts. If something feels off, don’t ignore it. One buyer shared how they were limited to a short neighborhood test drive and later discovered major transmission issues. Avoid this mistake by insisting on a thorough test drive. If the seller refuses, negotiate a solution that works for both of you.

By carefully inspecting and test driving the car, you’ll gain confidence in your purchase. This step ensures you’re making an informed decision and helps you avoid costly surprises down the road.

Comparing Financing Options to Finance a Used Car

Finding the right way to pay for a used car can save you money. Different lenders have different offers, so it’s important to compare them. Let’s look at your choices.

Exploring Banks, Credit Unions, Dealerships, and Online Lenders

There are several ways to finance a used car. Each option has its own benefits, so take time to explore.

Banks: Banks often have good interest rates, especially for their customers. They may also provide tools to help you plan your payments.

Credit Unions: These are member-based and usually offer lower rates than banks. Members often get flexible terms and friendly service.

Dealerships: Dealerships make financing easy since everything is done there. But their rates might not be the lowest, so compare them with others.

Online Lenders: Online lenders are quick and simple to use. Many let you pre-qualify without hurting your credit score. They often compete by offering great rates.

By checking these options, you’ll find the best way to finance your car.

Comparing Interest Rates, Loan Terms, and Total Costs

After finding lenders, compare their offers to get the best deal.

Interest Rates: This is the extra money you pay on the loan. Lower rates mean you pay less overall. Even a small rate difference can save you a lot.

Loan Terms: This is how long you’ll take to pay back the loan. Shorter terms mean higher monthly payments but lower total costs. Longer terms lower monthly payments but cost more in the end.

Total Costs: Don’t just look at the monthly payment. Use tools to see the full loan cost, including interest. This helps you avoid surprises and stay within budget.

“It’s smart to check with different lenders to find the best deal.”

Look at the Annual Percentage Rate (APR), which shows the true cost of the loan, including fees. Pre-qualifying with several lenders can help you find the best rates without committing.

By comparing rates, terms, and costs, you’ll make a smart choice. This step helps you get a loan that fits your financial needs.

Getting the Best Deal When Buying a Car

Learning About Car Prices and Using Tools

Before talking about prices, know the car’s value. This helps you feel ready to negotiate. Use websites like Kelley Blue Book or Edmunds to check fair prices. These tools show prices based on the car’s type, age, miles, and condition.

Next, find out how much the dealer paid for the car. This is often less than the price they show. Knowing this can help you ask for a better deal. Focus on the out-the-door price, which includes all taxes and fees. This way, you won’t be surprised by extra costs.

It’s smart to get price offers from different dealers. Comparing these offers shows who gives the best deal. Sharing these prices with other dealers can make them lower their prices to compete.

“Knowing the car’s value makes you stronger in negotiations.”

By using tools and doing research, you’ll feel ready to talk about the price.

Negotiating Smartly and Knowing When to Leave

Negotiating doesn’t have to be scary. Start by knowing your budget and sticking to it. Show the seller your research to prove you’re prepared. Talk about the car’s value and other offers you’ve seen. This shows you’re serious and informed.

Look at the total car cost, not just monthly payments. Low monthly payments might mean a longer loan and more money spent overall. Stay focused on the car’s price and loan terms.

If the seller offers extras, think about if you really need them. Saying no to unneeded features can lower the price. Decide what’s most important for you and your family before negotiating.

Sometimes, walking away is the best choice. If the seller won’t meet your price or adds surprise fees, leave. Walking away shows you’re not desperate and might lead to a better deal later. Remember, there are many cars and dealers to choose from. Waiting can save you money.

By staying calm and knowing when to leave, you stay in control. These tips will help you get a great deal and feel happy with your choice.

Finalizing the Purchase of a Used Car

Buying your used car is an exciting moment. It’s when all your hard work pays off. To make sure everything goes well, follow these steps.

Completing Paperwork and Checking the Sales Contract

Before driving your car home, finish the paperwork. This step is important because it makes the car officially yours. Here’s what you’ll need:

Bill of Sale: This paper shows the car’s price, VIN, and buyer and seller names. Check that all details are correct.

Title Transfer: The title proves who owns the car. If buying from a private seller, they must sign it over to you. Dealerships usually handle this for you.

Sales Contract: Read the contract carefully before signing. Look for hidden fees or extra charges. Check terms like warranties and return policies.

Pro Tip: Take your time to read everything. Ask questions if something is unclear. It’s better to understand now than have problems later.

Loan Documents: If you’re using a loan, sign the loan papers. Make sure the interest rate, loan term, and monthly payment match what you agreed on.

By completing these steps, you’ll feel confident about your purchase and avoid future problems.

Registering the Car and Getting Insurance

After the paperwork, register your car and get insurance. These are required by law in most places.

Registering Your Car

Car registration links the car to you and lets you drive legally. Here’s how to do it:

Go to your local DMV office with the title, bill of sale, and proof of insurance.

Pay the registration fees and taxes. These costs depend on your state.

Some states need a car inspection or emissions test first. Check your state’s rules to avoid delays.

In some states, not registering your car can lead to fines or losing your license. Don’t skip this step.

Getting Insurance

Driving without insurance is unsafe and illegal in most states. Here’s how to get covered:

Compare insurance quotes from different companies to find the best deal.

Pick a policy that meets your state’s minimum requirements. You can add extra coverage for more protection.

Give your insurance details to the DMV when registering your car. Some states won’t let you register without proof of insurance.

Driving without insurance can lead to fines or losing your license. Protect yourself by getting insured before driving.

By finishing the paperwork, registering your car, and getting insurance, you’ll be ready to enjoy your car. These steps make sure you’re driving legally and safely.

Getting a used car with financing is easier with steps. First, know your budget and check financing options. Look for a car that matches what you need. Inspect it and take it for a test drive to check quality. Compare loan offers to find the best one. Negotiate wisely and review all paperwork closely. Being prepared makes everything simpler. Get pre-approved for a loan and compare lenders to save cash. Following these steps helps you buy a car without stress.

FAQ

Do you have different rates for buying a new car vs. buying a used car?

Yes, lenders often offer different rates for new and used cars. New cars usually come with lower interest rates because they have a higher resale value and are less risky for lenders. Used cars, on the other hand, may have slightly higher rates due to depreciation and potential maintenance concerns. It’s always a good idea to compare rates from multiple lenders to find the best deal for your situation.

How does my credit score affect my car loan?

Your credit score plays a huge role in determining your loan terms. A higher score can help you secure lower interest rates, saving you money over time. If your score is lower, lenders might offer higher rates or require a larger down payment. Before applying for a loan, check your credit score and work on improving it if needed. Even small improvements can make a big difference in your loan offers.

Is it better to get financing through a dealership or a bank?

Both options have their pros and cons. Dealerships offer convenience since they handle everything on-site, but their rates might not always be the lowest. Banks and credit unions often provide competitive rates, especially if you’re already a customer. To make the best choice, compare offers from both and focus on the total cost of the loan, not just the monthly payment.

What’s the benefit of getting pre-approved for a car loan?

Getting pre-approved gives you a clear idea of your budget and shows sellers you’re a serious buyer. It also helps you avoid overspending since you’ll know exactly how much you can borrow. Pre-approval can streamline the buying process and give you leverage during negotiations. Many lenders allow you to get pre-approved online, making it a quick and easy step.

How much should I put down as a down payment?

A down payment of at least 20% of the car’s price is recommended, but any amount helps. A larger down payment reduces the amount you need to borrow, which can lower your monthly payments and interest rate. If 20% isn’t possible, aim for as much as you can comfortably afford. Every dollar you put down upfront saves you money in the long run.

Can I negotiate the price of a used car?

Absolutely! Negotiating is a key part of buying a used car. Start by researching the car’s market value using tools like Kelley Blue Book or Edmunds. Use this information to make a fair offer. Be confident and stick to your budget. If the seller won’t budge, don’t hesitate to walk away. There are plenty of other cars available, and patience can lead to a better deal.

What should I look for during a test drive?

During a test drive, focus on how the car feels and performs. Pay attention to the steering, brakes, and acceleration. Listen for unusual noises and check for vibrations. Test the car on different types of roads, including highways and city streets. Don’t forget to try parking and reversing to see how easy it is to maneuver. Trust your instincts—if something feels off, it’s worth investigating further.

Are certified pre-owned (CPO) cars worth it?

CPO cars can be a great choice if you want reliability without the cost of a new car. These vehicles undergo thorough inspections and come with warranties from the manufacturer. They often include perks like roadside assistance and better financing rates. While CPO cars may cost more than regular used cars, the added peace of mind can make them worth the investment.

What documents do I need to finalize the purchase?

To complete your purchase, you’ll need a bill of sale, title transfer, and proof of insurance. If you’re financing, you’ll also need to sign loan documents. Double-check all paperwork for accuracy, including the sales contract. Make sure there are no hidden fees or unexpected charges. Taking your time with this step ensures a smooth and hassle-free buying experience.

Can I refinance my car loan later?

Yes, refinancing is an option if you want to lower your interest rate or monthly payment. It’s especially helpful if your credit score improves after you buy the car. To refinance, shop around for better rates and terms, just like you did when you first got the loan. Keep in mind that refinancing may come with fees, so weigh the costs and benefits before making a decision.

See Also

Improving Automotive HSD Systems Through USB Integration

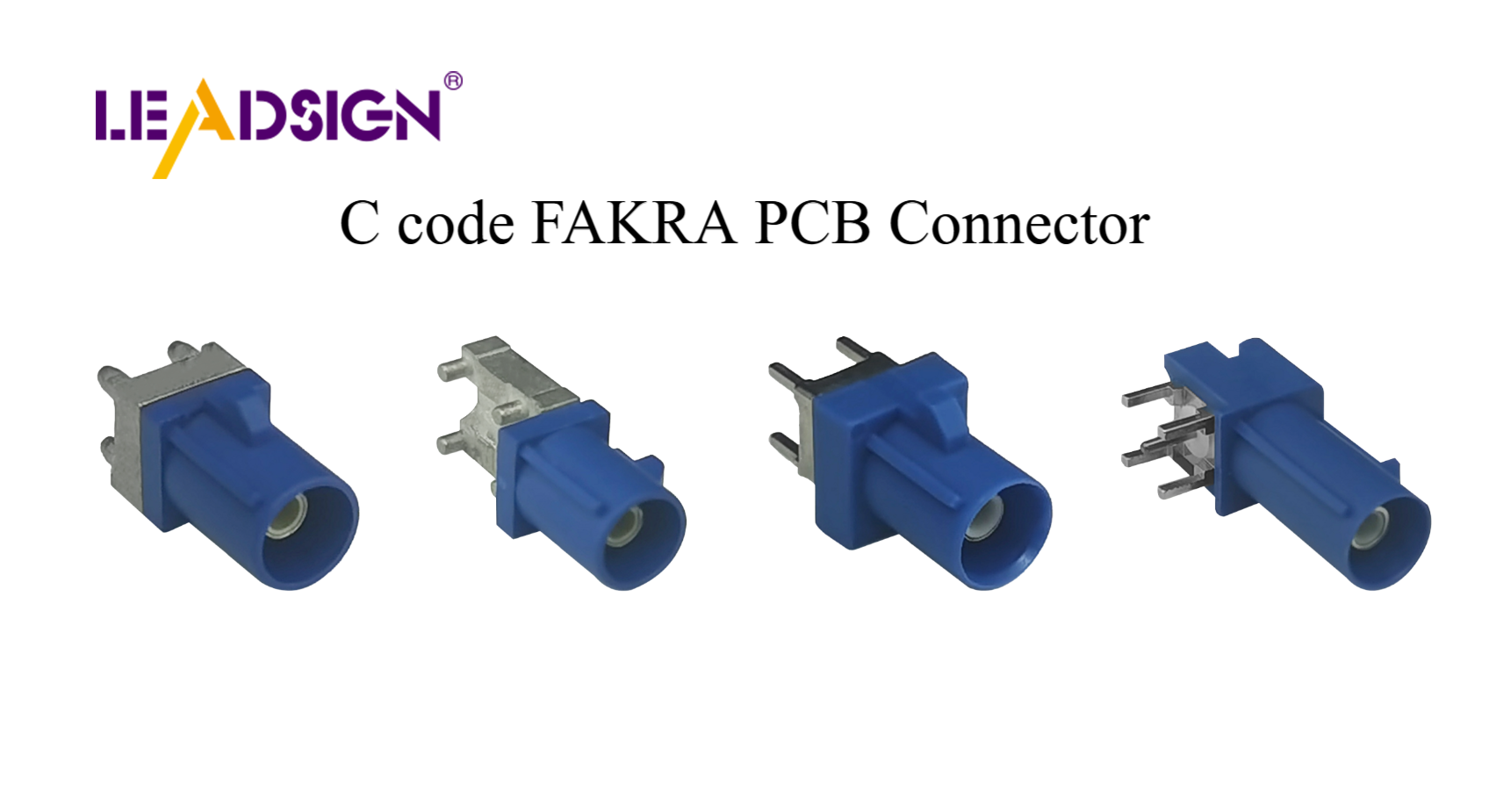

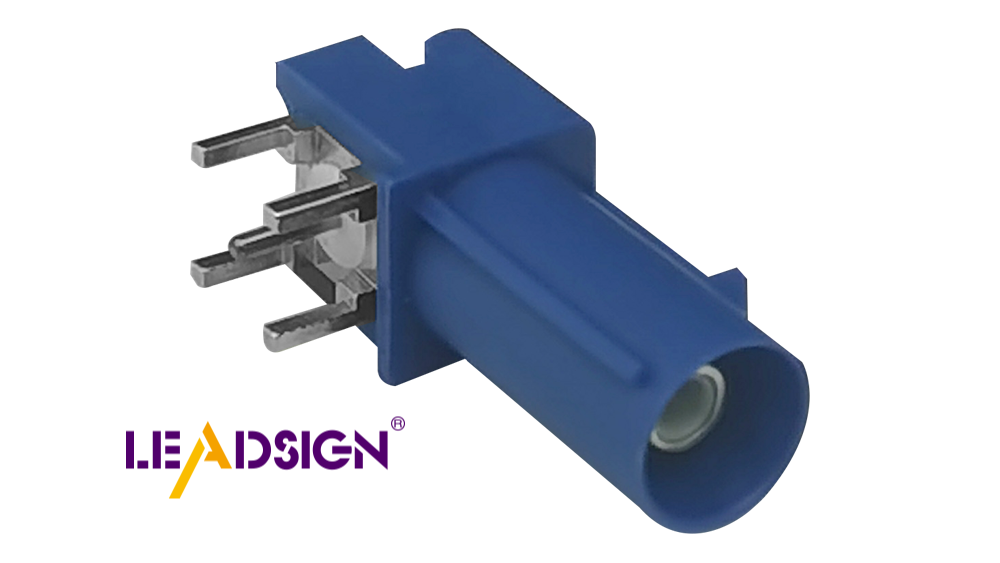

Discovering Advantages of Fakra Connectors in Vehicles

Maximizing Data Transfer in Vehicles with Advanced Connectors

Revealing Opportunities with High-Speed FAKRA-Mini Connectors