Affordable Auto Network Cars Financing Secrets Revealed

Getting your dream car doesn’t have to cost too much. By learning about auto network cars financing, you can manage your car purchase better. Many dealers work with lenders to make it easier. Knowing how to choose these options helps you a lot. Check interest rates, get preapproved, and stick to your budget. This can save you lots of money. With good planning, you’ll avoid big mistakes. You’ll drive away happy, knowing you made a smart choice.

Key Takeaways

Explore auto network financing for a streamlined car buying experience, connecting you with multiple lenders in one place.

Get preapproved for a loan to understand your budget and enhance your negotiating power at dealerships.

Compare interest rates and loan terms from various lenders to secure the best deal and save money over time.

Improve your credit score before applying for a loan to qualify for lower interest rates and better financing terms.

Be vigilant about hidden fees in loan agreements; always ask for a full list of costs to avoid surprises.

Negotiate loan terms with lenders by leveraging competing offers to get the best rates and conditions.

Set a realistic budget that includes all costs associated with car ownership to prevent financial strain.

Understanding Auto Network Financing

What Is Auto Network Financing?

Definition and how it differs from traditional car loan options.

Auto network financing links buyers with lenders through dealerships or platforms. Unlike regular car loans, where you go to banks yourself, this method is easier. It gives you many loan choices in one place. For example, CarMax works with different lenders, so you can compare offers easily. This saves time and gives you more options.

With traditional loans, you do all the work, like finding lenders and negotiating terms. Auto network financing simplifies this by connecting you to lenders directly. It’s a good choice for people who want a quick and easy process.

Benefits of financing through auto network cars.

Using auto network cars for financing has many benefits:

Convenience: You can see many loan options in one spot, online or at a dealership.

Competitive Rates: Networks often have lenders with special deals. For example, Autopay offers rates as low as 4.67% APR for some buyers.

Tailored Solutions: Networks help with different needs, like buying new cars or refinancing. Some, like Santander Consumer Finance, work with carmakers to offer special programs.

Faster Approvals: Digital tools like e-signatures make approvals quicker and reduce paperwork.

This option gives you choices that match your financial plans.

How Auto Network Financing Works

The role of auto networks in connecting buyers with lenders.

Auto networks connect buyers with lenders who can fund car purchases. These networks include banks, credit unions, and auto lenders. For example, Carvana offers its own financing and works with other lenders for better rates. This gives you many options to choose from.

When you visit a dealership or website, the network checks your financial details. Then, it matches you with lenders that fit your needs. This saves you time since you don’t have to contact each lender yourself. Some networks, like Santander Consumer Finance, use technology to make the process faster and easier.

Typical financing process, including down payment and preapproval.

The financing process usually includes these steps:

Preapproval: Get preapproved for a loan to know your budget. Many lenders in auto networks offer this service to make it simple.

Down Payment: Pay a down payment to lower the loan amount. A bigger down payment means smaller monthly payments and less interest.

Loan Application: Apply for a loan through the auto network. The network reviews your info and connects you with lenders offering good terms.

Loan Offers: Compare the offers you get. Check interest rates, loan terms, and fees. For example, CarMax gives you options through its lender partnerships.

Final Approval: Choose a lender, finish the paperwork, and sign the loan agreement.

This process helps you find the right loan without extra stress. Auto networks give you tools to make smart choices and save money.

Research and Compare Financing Options

Comparing Interest Rates and Loan Terms

Why interest rates matter and how to find the best ones.

Interest rates decide how much your car loan will cost. Even a small rate change can save or cost you a lot. For example, auto loan rates for new cars may range from 4.99% APR for 36 months to 6.39% for 60 months. Lower rates mean paying less interest, saving you money.

To get the best rates, compare offers from different lenders. Banks, credit unions, and dealership financing networks often have unique rates. Some lenders offer rates as low as 1.65% for new cars, which can save you more. Use online tools to compare rates and pick the cheapest option.

Understanding loan terms and their impact on monthly payments.

Loan terms are how long you take to repay your loan. They affect your monthly payments and total interest. Shorter terms, like 36 months, have lower rates but higher payments. Longer terms, like 60 months, lower payments but increase total interest.

For instance, a 48-month term for a used car might have rates between 6.45% and 7.21%. A 36-month term could range from 6.33% to 7.17%. Pick a term that fits your budget and keeps costs low. Balance what you can afford with paying less overall.

Evaluating Lenders Within Auto Networks

Key factors to consider when choosing a lender.

Choosing the right lender is important for good financing terms. Look for lenders with competitive interest rates, flexible terms, and clear fees. Check reviews and ask for advice. Some lenders work with auto network cars to offer special deals.

Think about the lender’s approval process and customer service. A fast and easy process saves time and stress. Some lenders use digital tools for quick approvals and less paperwork. Make sure the lender matches your financial needs and goals.

Tools and resources for comparing lenders.

Use online tools to compare lenders easily. Websites like Bankrate and NerdWallet show auto loan rates, terms, and fees side by side. Many auto network cars platforms also have tools to compare lenders. Some let you enter your details and get loan offers quickly.

Use calculators to estimate monthly payments and total loan costs. These tools help you choose wisely and avoid overpaying. By using these resources, you can find the best lender for your needs.

Preapproval and Budgeting

Benefits of getting preapproved for a car loan.

Getting preapproved for a car loan helps you know your budget before shopping. With auto loan preapproval, you learn the loan amount, rate, and terms you qualify for. This avoids surprises and gives you more power to negotiate at dealerships.

Preapproval also lets you compare lenders without committing. For example, arranging financing before visiting a dealership often gets you better rates than dealership financing. It’s a smart way to stay in control of your purchase.

Setting a realistic budget for your car purchase.

To buy wisely, set a budget that fits your finances. Start by figuring out how much you can pay for a down payment and monthly payments. A bigger down payment lowers the loan amount, reducing payments and interest.

Include extra costs like insurance, taxes, and maintenance. Use online calculators to check if your expenses fit your income. By setting a realistic budget, you can avoid money problems and enjoy your car stress-free.

Maximize Savings

Improve Your Credit Score

How credit scores affect financing rates.

Your credit score is very important for getting good loan rates. A higher score means lower rates, saving you lots of money. For example, people with great credit might get a 4% rate. Those with bad credit could pay over 15%. This difference changes your monthly payments and total interest.

Only 22% of people know how much bad credit costs. Someone with poor credit might pay $5,000 more in interest on a $20,000 car loan over 60 months than someone with excellent credit.

Improving your credit score helps you get better loan deals. This lowers your costs and makes it easier to stick to your budget.

Steps to boost your credit score before applying.

Raising your credit score is not too hard. Try these steps before applying for a loan:

Pay Bills on Time: Late payments hurt your score. Use reminders or auto-pay to stay on track.

Lower Credit Card Balances: Keep your credit use under 30%. Paying off balances helps quickly.

Check Your Credit Report: Get a free report and look for mistakes. Fixing errors can improve your score.

Avoid New Credit Applications: New applications can lower your score. Focus on keeping current accounts in good shape.

These steps can help you get lower loan rates and better terms.

Negotiate Financing Terms

Tips for negotiating better interest rates and terms.

Talking to lenders about better terms can save money. First, check average loan rates for your credit score. Use this info to ask for better deals. Show lenders your good credit or a big down payment to help your case.

Ask to lower the interest rate or remove extra fees. If a lender offers a high rate, ask for a lower one. Many lenders will adjust terms to win your business.

Leveraging competing offers to your advantage.

Comparing offers from different lenders gives you power. Share better offers with lenders to get them to match or beat the deal. For example, if one lender offers 5% and another offers 4.5%, use this to negotiate.

Getting preapproved by banks or credit unions often gets you better rates than dealerships. Preapproval gives you an advantage when negotiating.

Using competing offers helps you get a loan that fits your budget.

Take Advantage of Promotions and Incentives

Common promotions offered by auto networks.

Auto network cars often have special deals to attract buyers. These include cashback offers, zero-interest loans for a short time, or discounts on certain models. Some networks work with carmakers to give exclusive deals during sales events.

These promotions can lower your loan costs. Watch for holiday sales or special programs that meet your needs.

How to identify and capitalize on seasonal deals.

To find great deals, check promotions from auto networks and dealerships. Visit their websites or sign up for updates. Buying during end-of-year or holiday sales can get you better terms.

Use online tools to compare deals. Look at the total loan cost, including interest and fees, to see if it’s worth it. Staying informed helps you use promotions to save money on your loan.

Avoid Common Pitfalls

Hidden Fees and Charges

Common hidden fees to watch out for.

When buying a car, hidden fees can raise costs fast. These fees are often in the small print of loan papers. Examples include origination fees for loan processing and prepayment penalties for early payments. Missing payments can also lead to late fees and extra charges.

Dealerships might add costs like documentation fees or dealer add-ons. These are not always shared upfront but can make your loan more expensive. Always ask for a full list of fees before agreeing to anything. Knowing all costs helps you avoid surprises.

How to read and understand loan agreements.

Reading your loan agreement carefully can save you money. Start by checking the Annual Percentage Rate (APR). This shows the interest rate and extra fees, giving you the total loan cost. Look for details about late fees, early payment penalties, and other charges.

Check the payment schedule to ensure it fits your budget. If something is unclear, ask questions. Lenders must explain everything clearly. Taking time to understand your loan protects you from hidden costs and helps you make smart choices.

Unfavorable Loan Terms

Risks of long-term loans and high-interest rates.

Long-term loans may seem good because of lower payments. However, they can cost more in the end. A 72-month loan has smaller payments than a 48-month loan. But paying interest for extra years adds up and costs thousands more.

High-interest rates are also risky, especially with a low credit score. Higher rates mean more money goes to interest instead of lowering your loan balance. This makes it harder to pay off your loan quickly. Choose the shortest term and lowest rate you can afford to save money.

How to avoid predatory lending practices.

Some lenders take advantage of buyers who know little about loans. They may offer loans with high rates, hidden fees, or bad terms. To avoid this, research lenders carefully. Read reviews and check their reputation.

Compare offers from banks, credit unions, and other lenders. Preapproval from trusted places gives you an advantage when talking to dealerships. Never sign papers under pressure. Take your time to review terms and ask for advice if needed. Being careful helps you avoid unfair loans and get a good deal.

Overextending Your Budget

The dangers of financing more than you can afford.

Spending more than you can afford can cause money problems. High payments can stretch your budget, leaving less for other needs. If unexpected bills come up, like repairs, you might miss payments. This can hurt your credit score and lead to losing your car.

Borrowing too much can also lead to negative equity. This means you owe more than your car’s value. Selling or trading your car becomes harder without losing money. Staying within your budget avoids these problems and keeps your finances stable.

Tips for staying within your financial limits.

To stay on track, plan your budget before car shopping. Decide how much you can pay upfront and monthly. Use online tools to see costs for different loan terms and rates.

Stick to your budget by choosing cars you can afford. Don’t let dealerships push you toward pricier options. Getting preapproved for an auto loan helps you stay focused and know your spending limit. Careful planning lets you enjoy your car without money worries.

Getting a good loan for your car needs smart choices. Begin by checking different lenders and comparing their interest rates. Pick a loan with a low rate to save money. Work on improving your credit score before applying for a loan. Get preapproved to know how much you can spend. Talk to lenders to get better terms and read loan papers carefully. This helps you avoid extra fees or bad deals. Stay focused and plan well. You can find a loan that matches your budget and goals.

FAQ

What is auto network financing, and how does it work?

Auto network financing links buyers with lenders through dealerships or websites. Instead of finding lenders yourself, the network does it for you. It shows you many loan options in one place. After sharing your financial details, the network finds lenders that match your needs. This saves time and helps you get better rates and terms.

Can I get preapproved for an auto loan through an auto network?

Yes, many auto networks let you get preapproved. Preapproval helps you know your budget and loan choices before car shopping. It also gives you more power to negotiate at dealerships. Knowing your loan amount, rate, and terms ahead of time helps you decide confidently.

How do I compare lenders within an auto network?

Use tools from the auto network to compare lenders. Check interest rates, loan terms, and fees. Websites like Bankrate or NerdWallet can also help you compare options. Look for lenders with good rates, clear terms, and positive reviews. Comparing offers helps you pick the best deal.

Does my credit score affect my ability to secure financing?

Yes, your credit score is important for getting good loan terms. A higher score means lower interest rates, saving you money. For example, great credit might get you a 4% rate, while poor credit could mean rates over 15%. Improving your credit score before applying can help you get better deals.

What are the benefits of making a larger down payment?

A bigger down payment means you borrow less money. This lowers your monthly payments and total interest costs. It also shows lenders you’re responsible, which can help you get better loan terms.

Are there hidden fees I should watch out for?

Yes, hidden fees can make your loan more expensive. Common fees include origination fees, prepayment penalties, and late payment charges. Dealerships may also add documentation fees or extra costs. Always ask for a full list of fees before signing anything.

Pro Tip: Read the loan agreement carefully, especially the APR, to know the total loan cost.

Can I negotiate the terms of my auto loan?

Yes, you can negotiate for better rates and terms. Start by comparing offers from different lenders. Use better offers to ask for lower rates or fewer fees. Show lenders your good credit or large down payment to strengthen your case.

What promotions or incentives can I take advantage of?

Auto networks and dealerships often have special deals like cashback offers, zero-interest loans, or discounts on certain cars. These deals can lower your loan costs. Watch for seasonal sales or programs from manufacturers and lenders.

How do I avoid overextending my budget when financing a car?

Set a budget before shopping for a car. Decide how much you can pay upfront and monthly. Include extra costs like insurance, taxes, and maintenance. Stick to your budget and don’t borrow more than you can afford.

What happens after I get approved for financing?

After approval, the lender will explain the loan details. You’ll review the rates, terms, and conditions before signing. Ask questions and make sure the loan fits your financial goals.

See Also

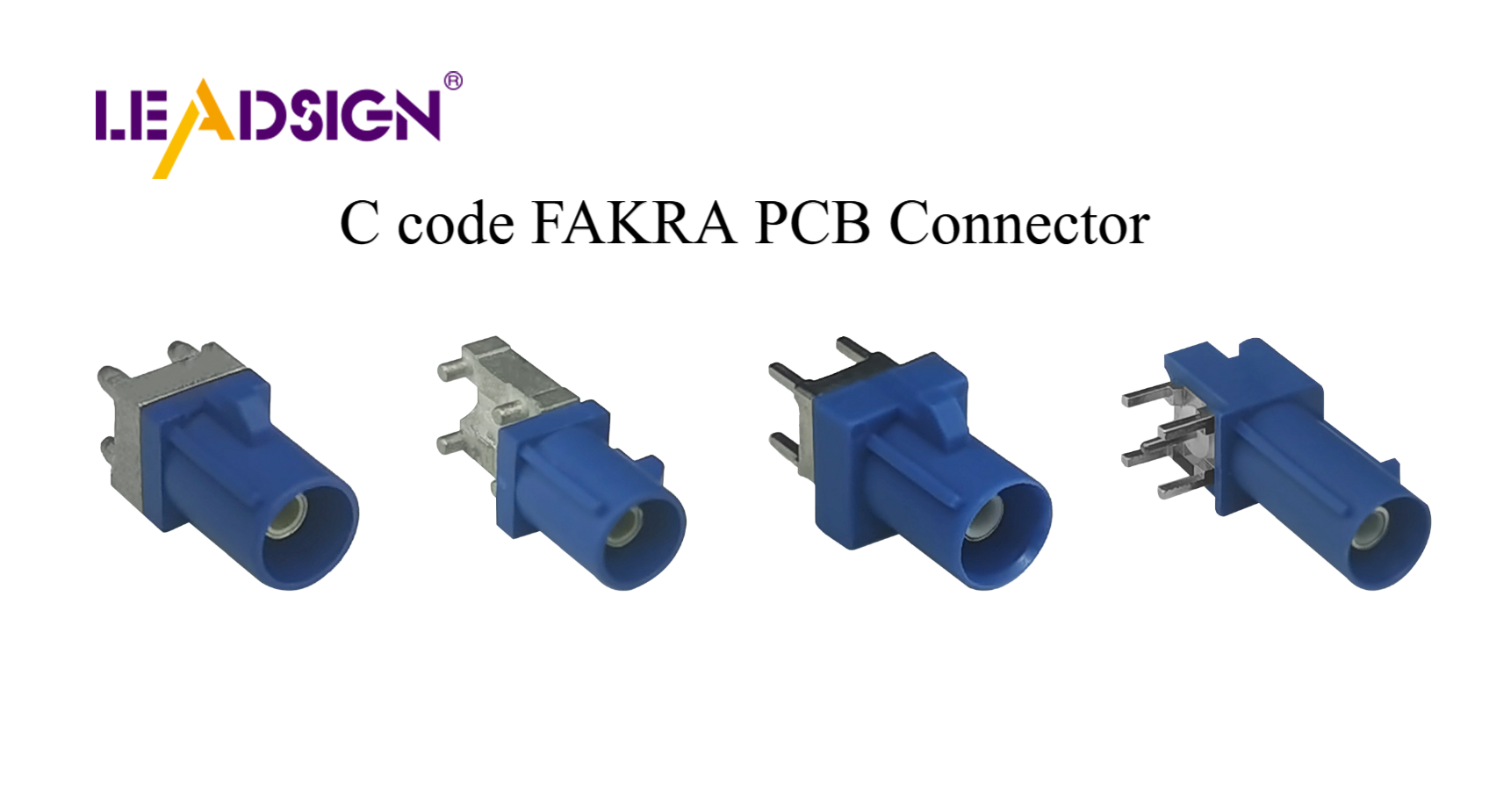

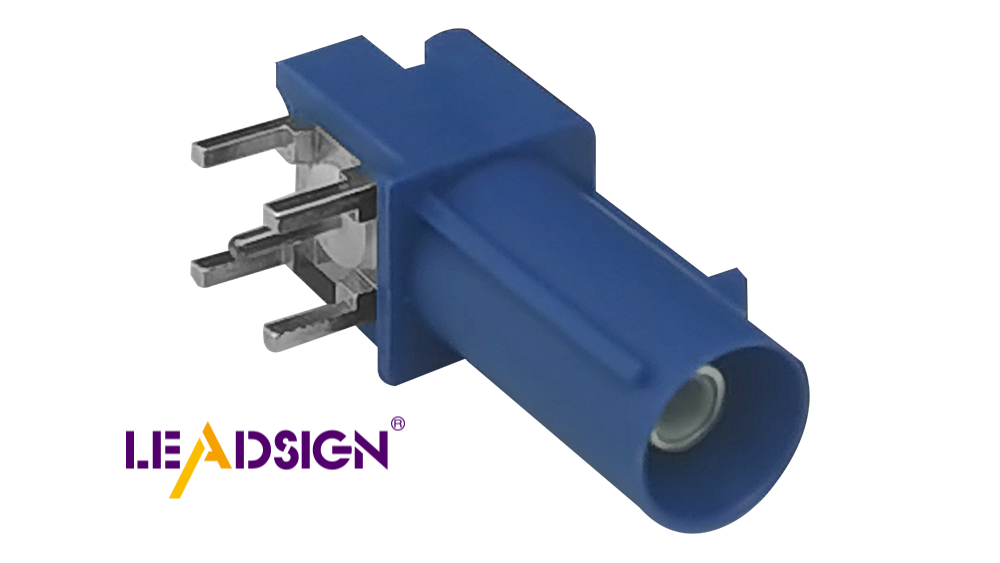

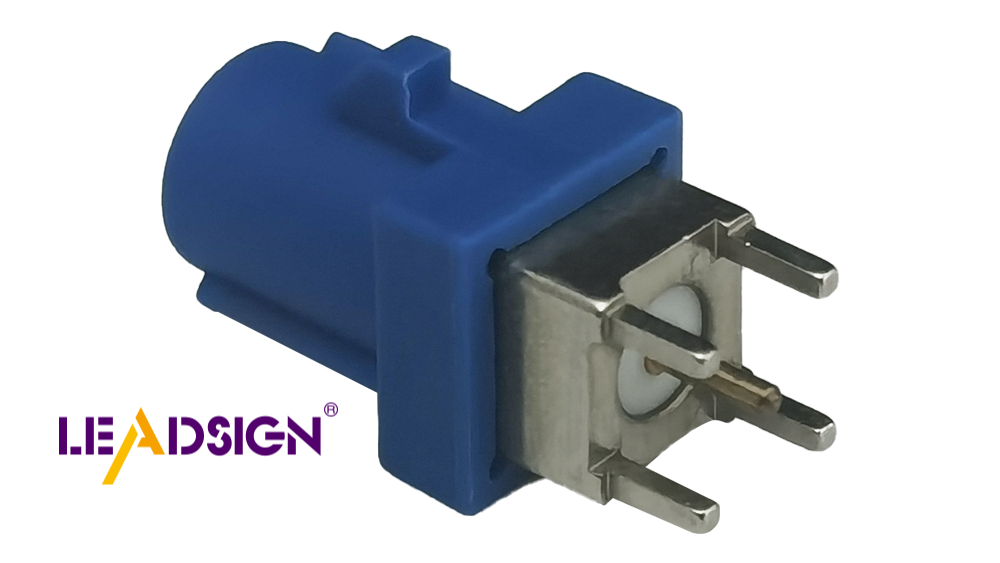

Harnessing High-Speed FAKRA-Mini Connectors for Automotive Innovation

FAKRA Connectors: Essential Components in Automotive Technology

Maximizing HFM Benefits for Enhanced Autonomous Driving Solutions

Understanding the Advantages of FAKRA Connectors in Vehicles

Transforming Autonomous Driving with Innovative HFM Technology